Content

For a small eCommerce business, financial accounts are vital regarding bills, a rainy day fund, and that inventory meets customers’ needs. Therefore, it is fundamental that a small business owner creates and utilizes a chart of accounts. This financial organizational tool gives businesses an insight into all company transactions.

- Deferred interest is also offset against receivables rather than being classified as a liability.

- The chart of accounts should give anyone who is looking at it a rough idea of the nature of your business by listing all the accounts involved in your company’s day-to-day operations.

- Understanding which accounts you need can be complicated, and it’s not always easy to change something later.

- It’s best practice to wait until the end of the year—after a close—to merge, rename, or delete accounts.

- Every chart of accounts is structured this way, though you can add additional accounts or sub-accounts to better track transactions specific to your business type.

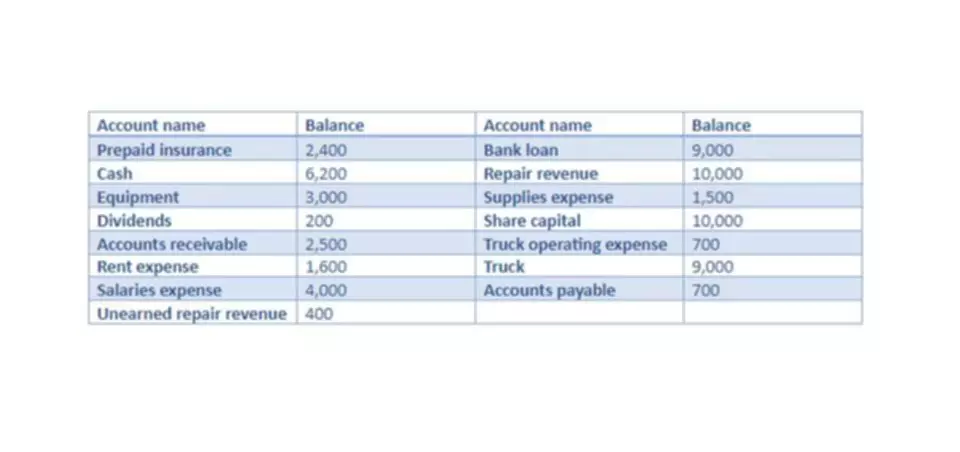

A chart of accounts is a financial organizational tool that provides a complete listing of every account in the general ledger of a company, broken down into subcategories. If you don’t leave gaps in between each number, you won’t be able to add new accounts in the right order. For example, assume your cash account is and your accounts receivable account is 1-002, now you want to add a petty cash account.

Chart of Accounts – Example | Format | Structured Template | Definition

She has owned a bookkeeping and payroll service that specializes in small business, for over twenty years. By separating each account by several numbers, many new accounts can be added between any two while maintaining the logical order. If you want to take your company and yourself to the next level, thenclick here to learn more about the premier financial leadership development platform.

It provides a way to categorize all of the financial transactions that a company conducted during a specific accounting period. You can create your own chart of accounts without using accounting software. But it’s easier to use software that builds a chart of accounts for you.

INTERCOMPANY PAYABLES

He then taught tax and accounting to undergraduate and graduate students as an assistant professor at both the University of Nebraska-Omaha and Mississippi State University. Tim is a Certified QuickBooks Time Pro, QuickBooks ProAdvisor for both the Online and Desktop products, as well as a CPA with 25 years of experience. He most recently spent two years as the accountant at a commercial roofing chart of accounts example company utilizing QuickBooks Desktop to compile financials, job cost, and run payroll. If the business has more than one checking account, for example, the chart of accounts might include an account for each of them. Financial accounting is the process of recording, summarizing and reporting the myriad of a company’s transactions to provide an accurate picture of its financial position.

To see a working example of the entire hierarchy, click the button to download the chart of accounts template that we actually use as a starting point on our engagements. Understanding which accounts you need can be complicated, and it’s not always easy to change something later. An accountant or bookkeeper can help you create a customized CoA or rework your existing CoA.

Operating Revenue Accounts

Modern accounting software lets you make journal entries as and when you need them, so you can manage your chart of accounts to meet the business’s changing needs. And accounting software can produce powerful and timely reports for management and statutory purposes. Define the business’s account types based on how the business works. Make sure the chart of accounts gives a clear picture of where money is coming from and where it’s going.

Is liability a debit or credit?

Typically, when reviewing the financial statements of a business, Assets are Debits and Liabilities and Equity are Credits.

Some of the components of the owner’s equity accounts include common stock, preferred stock, and retained earnings. The numbering system of the owner’s equity account for a large company can continue from the liability accounts and start from 3000 to 3999.

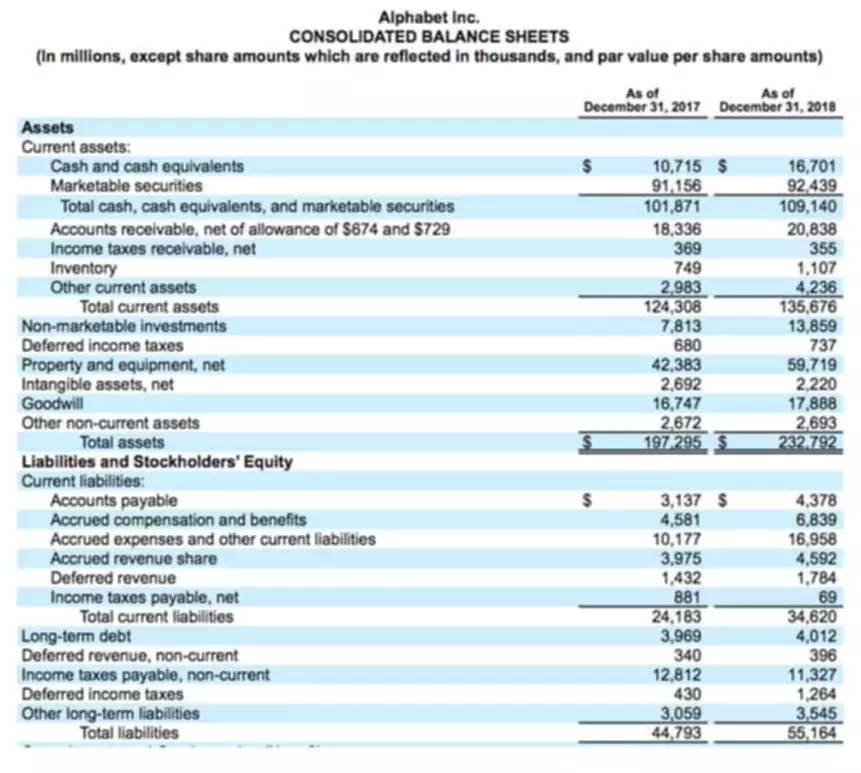

This separate tracking gives managers a better understanding of where money is coming into and going out of the business on a day-to-day basis. The list of each account a company owns is typically shown in the order the accounts appear in its financial statements. That means that balance sheetaccounts, assets, liabilities, and shareholders’ equity are listed first, followed by accounts in theincome statement—revenues and expenses. The chart of accounts appears as a spreadsheet containing numerous categories and subcategories displayed in the order of the financial statement. These categories include revenue, liabilities, assets, etc., broken down into other categories. For example, assets can be broken down into inventory, prepaid expenses, fixed assets, and marketable securities. From there, companies can organize their spreadsheet whichever way they prefer.

- Check out our guide on what bookkeeping is for more information about the tasks that bookkeepers perform.

- But if you are starting from scratch, then the following is great place to start.

- This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

- Note that business type likely influences a CoA less than ownership structure, business size, payment collection methods and policies, and cash management strategies.

- The owner’s equity accounts to include vary based on the entity type of the business.

You’ll want to be careful to choose the correct account type for each transaction. The account type will determine what transactions appear on the balance sheet and income statement. In short, it’s an index of all the financial accounts in your company’s general ledger. It allows you to break down all the transactions that your business made during a specific period into different subcategories. By separating out your revenue, liabilities, assets, and business expenditures, a chart of accounts enables you to gain insight into the effectiveness of different areas of your business. A chart of accounts is a business’s list of financial accounts, reflecting the structure of the company’s balance sheet and income statement.

Default CoA Accounts

As your business grows, you’ll likely need more accounts that are specific to your business. The more complex your business, the more likely you’ll want to tailor your chart of accounts to your needs. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. You want to avoid changes as much as possible, but in no event should you remove lines from a chart of accounts or reorganize it in the middle of an accounting period. Equity accounts begin with “3”, and there is plenty of room to add more equity types if the owners decide to sell part of their stakes.

When you’re producing a chart of accounts in Australia, consistency is key. Try to make a chart of accounts that won’t change for several years so that you can more easily compare results. If you keep adding new accounts, then it will become increasingly difficult to compare your financial information over a multi-year period. You should also regularly review the chart of accounts to see if any accounts contain inessential data. If they do, shut down these accounts to keep the chart at a manageable size.

Example Chart of Accounts

Income statements are divided into categories for revenue and gains and expenses and losses. The best way for you or your bookkeeper to manage your chart of accounts is by using accounting https://www.bookstime.com/ software tailored for your business type. If you’re interested in a better accounting software solution for your business, check out The Ascent’s accounting software reviews.

- Create this hierarchy by using accounts and sub-accounts, also referred to as parent-child accounts.

- Your Tax CPA will define your chart of accounts in a way that makes filing your taxes easy – but that is a once per year event , whereas you have to live with your COA the other 364 days out of the year.

- When you have too many accounts, your Profit and Loss statement (P&L) is hard to read, and it’s challenging to spot trends over multiple categories.

- Initially, a company needs to decide the structure of its COA, the account types and the numbering pattern.

- For example, companies in the United States must have certain accounts in place to comply with the tax reporting requirements of the IRS .

- Accounting software frequently includes sample charts of accounts for various types of businesses.

- Accountants and business owners use the chart of accounts to organize how they make and spend money.